[ad_1]

International Seaways INSW, a Zacks Rank #1 (Strong Buy), is one of this year’s biggest market winners. INSW hit an all-time high in price this month in a sign of strength, all while most stocks hover in bear market territory. The company’s longevity and continued stock price ascent speak to management’s ability to adapt to the ever-changing market landscape. INSW sports a ‘B’ rating for our Zacks Momentum Style Score, indicating a strong likelihood that the stock propels higher on the powerful combination of positive earnings estimate revisions and stock price performance.

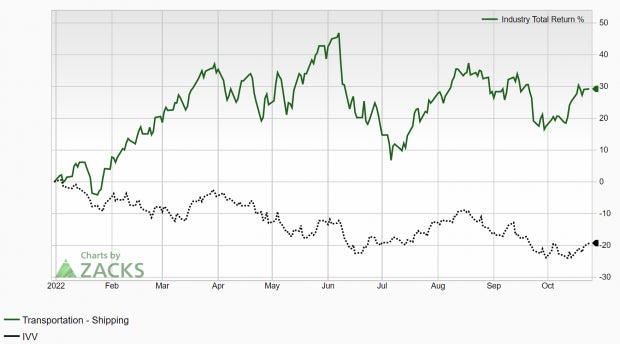

International Seaways is part of the Zacks Transportation – Shipping industry, which is currently ranked in the top 16% out of over 250 industries. This group has widely outperformed the market with at 29% return year-to-date:

Image Source: Zacks Investment Research

Despite shipping rates coming down from their peak, companies within the shipping industry have continued to flourish. While an absence of high congestion has established a path to lower rates, any changes in China’s Covid-zero policy or possible ceasefire agreements in the Russia-Ukraine war have the potential to lift rates again.

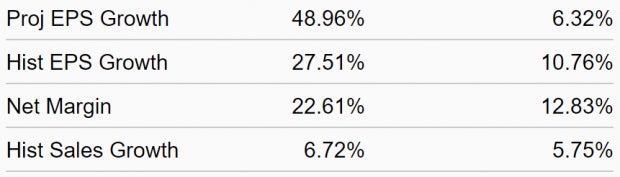

Why has this group continued to shine despite lower shipping rates? Two reasons – accelerated earnings growth and relative undervaluation. We can see this illustrated by the industry table below:

Image Source: Zacks Investment Research

Historical research has illustrated that roughly half of a stock’s future price movement can be attributed to its industry group. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform over the next 3 to 6 months. By focusing on stocks within the top industries, we can provide a constant ‘tailwind’ to our investing success.

The industry also boasts a large number of highly ranked stocks per our Zacks Rank, serving as another confirmation signal that this group is a great place to be. Let’s take a deeper look at this leading stock.

Company Description

International Seaways owns and operates a fleet of over 80 oceangoing vessels and is engaged in the global transportation of crude oil and petroleum products. INSW serves independent and state-owned oil companies, oil traders, refinery operators, and international government entities.

As we saw in recent weeks with the release of September’s CPI data, inflation is going to linger. While the Fed has gone into overdrive with rate hikes, even committee officials have acknowledged that they’ve done little to stem a 40-year high in inflation. That’s good news for shipping companies, as they’re able to charge higher rates and pass along the higher costs of doing business.

Earnings Trends and Future Estimates

INSW has surpassed earnings estimates in three of the past four quarters, delivering a trailing four-quarter average earnings surprise of 8.31%. The shipping company most recently reported Q2 EPS back in August of $1.43/share, a 17.21% beat over the $1.22 consensus estimate. Consistently beating earnings estimates by a wide margin will generally help boost the stock price over time.

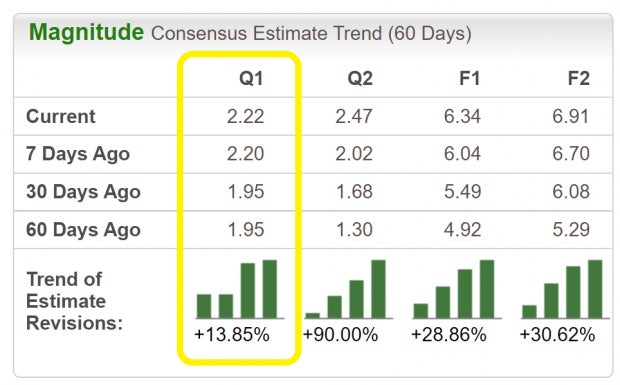

Analysts have increased their EPS estimates for INSW across the board. For the third quarter, estimates have been revised upward by 13.85% in the past 30 days. The Q3 Zacks Consensus EPS Estimate is now $2.22 per share, translating to astonishing potential growth of 452.37% relative to the same quarter last year.

Image Source: Zacks Investment Research

What the Zacks Model Unveils

The Zacks Earnings ESP (Expected Surprise Prediction) identifies companies that have recently witnessed positive earnings estimate revision activity. The idea is that this more recent information can serve as a better predictor of the future, giving investors a leg up during earnings season. When combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year backtest.

With an Earnings ESP +3.34% and a Zacks Rank #1 (Strong Buy) rating, another earnings beat may be in the cards for INSW investors when the company reports Q3 results on November 8th.

Let’s Get Technical

INSW shares have advanced nearly 180% this year. Only stocks that are in extremely powerful uptrends are able to make this type of price move while the market makes a series of lower lows. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how both the 50-day and 200-day moving averages (blue and red lines, respectively) are sloping up and have acted as support this year throughout the bullish move. The stock has been making a series of higher highs. With both strong fundamentals and technicals, INSW is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. And as we know, International Seaways has recently witnessed positive revisions. As long as this trend remains intact (and INSW continues to deliver earnings beats), the stock will likely continue its bullish run. Cautious investors may feel hesitant about investing in a stock that has come this far, but the fact is this elite company is still outperforming.

Bottom Line

Solid institutional buying should continue to provide a tailwind for the stock price. With a robust earnings history and an improving future outlook, INSW represents a great opportunity. The Zacks Rank #1 (Strong Buy) stock is a compelling investment with strong price momentum.

Healthy fundamentals combined with a strong technical trend certainly justify adding shares to the mix. Backed by a leading industry group and a lengthy history of earnings beats, it’s not difficult to see why this company is a compelling investment. If you’re looking for a way to diversify your portfolio, make sure to put INSW on your shortlist.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Seaways Inc. (INSW): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.