[ad_1]

Historically, August is a slow month for the markets.

Not this year.

During my recent webinar, I explained to my students why I expected this year to be TOTALLY DIFFERENT.

So far, I haven’t been disappointed.

Bed Bath & Beyond Inc. (NASDAQ: BBBY) was a ridiculous Supernova driven by a short squeeze.

I managed to spike some serious profits with fubo TV Inc. (NYSE: FUBO).

With markets taking a faceplant over the last few days, everyone wants to know what’s next…where I expect the major indexes to fall.

While I can’t tell you where the S&P 500 will be in a month, I CAN tell you what I expect for September and October and the preparations I’m making.

Because these two months could be CRUCIAL for your trading.

Two Months of Pure Danger

More crashes happen during the months of September and October than any other time during the year.

Just look at history:

- The Bank Panic of 1917

- The Stock Market Crash in 1929

- Black Monday in 1987

- The Subprime Mortgage Crisis in September 2008

- September 11, 2001

You can chalk it all up to pure coincidence.

But it doesn’t matter what you and I think, it’s what everyone else thinks.

You see, if enough people believe something is true and then act upon it, that thing becomes a reality.

That’s how bubbles form, whether it be in cryptos, oil stocks, or anywhere else.

I’m already seeing risk start to pull out of the penny stock and OTC markets.

BBBY was probably the beginning of the end for the multi-day runners.

Now, I’m starting to see Supernovas build and collapse within the same day or a couple of days.

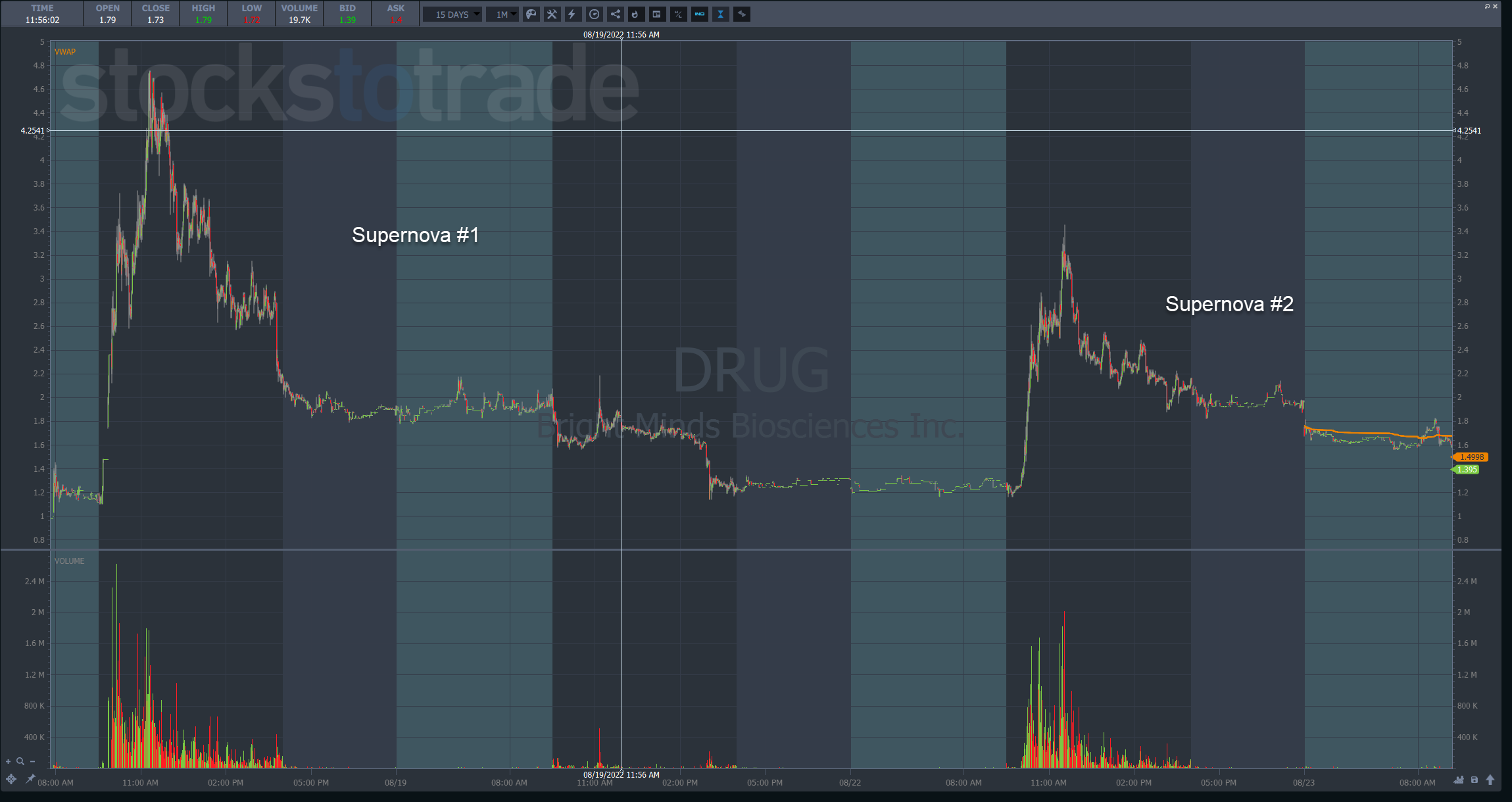

Take Bright Minds Biosciences Inc. (NASDAQ: DRUG) for example.

The stock made two excellent attempts at a run that went Supernova and failed the same day.

Compare that to the chart below of Ingelligent Living Application Group Inc. (NASDAQ: ILAG) which had multiple runs.

Even garbage stocks like FaZe Holdings Inc. (NASDAQ: FAZE) ran for multiple days before flaming out.

I still expect stocks to hit ridiculous spikes, just in shorter timeframes.

Calibration Keys

Given this outlook, these are the adjustments I plan to make.

First, and always the most important, I cut losses quickly.

While this is my gold standard, it becomes more important when there’s an outsized chance for a potential crash.

Yeah, I may give up a few profitable trades here and there for a few hundred or even a few thousand dollars.

But the flip side is a potential loss that swoops in before I can react and drains a chunk of my account.

Trading careers aren’t measured by how much money you make. They’re measured by survival.

Next, I’ll be on the lookout for news catalysts that lift stocks the same day.

My go-to news source is the StocksToTrade Platform’s Breaking News.

Our analysts deliver the headlines that matter to traders faster than anyone I’ve seen.

Candidly, they account for a huge portion of the trades I take.

Next, I’ll be keeping my position size small.

I did expand how much I played with in the last month when things heated up.

Now, I plan to cut back accordingly.

Smaller sizes make it much easier to trade mechanically without letting your emotions get in the way.

Additionally, I’ll be looking for clean patterns, especially panic dip buys on OTC stocks.

This is my bread and butter. It’s where I feel comfortable and where I make the most money.

Lastly, I want to spend time working on my entries and exits.

When I played tennis years ago, I spent hours each week working on the fundamentals. During non-tournament weeks, that went double.

September and October are my non-tournament weeks for the markets.

I want to nail down my trading mechanics, especially since I made a few mistakes in the last few weeks.

Final Thoughts

You’ll notice that half my plan revolves around a specific time period, and half is personal to me.

That’s the way it should be.

My trading plan balances market adjustments with personal adjustments.

No matter what the market is doing, I ALWAYS want to work on my trading basics.

—Tim

[ad_2]

Image and article originally from www.timothysykes.com. Read the original article here.