[ad_1]

The Philippines’ economic expansion was slower-than-expected in the second quarter as the fastest inflation in almost four years hurt consumption, which is a key growth driver.

Article content

(Bloomberg) — The Philippines’ economic expansion was slower-than-expected in the second quarter as the fastest inflation in almost four years hurt consumption, which is a key growth driver.

Article content

Gross domestic product grew 7.4% in the three months through June from a year ago, the Philippine Statistics Authority said Tuesday, slowing from 8.2% in the first quarter and compares with an 8.4% median estimate in a Bloomberg survey.

“The global headwinds, particularly imported inflation, particularly on energy and food contributed to noticeable slowdown,” Economic Planning Secretary Arsenio Balisacan said at a briefing in Manila.

Output shrank 0.1% from the previous quarter versus a median estimate of 0.4% gain, falling for the first time in a year. Household spending contracted by 2.7% last quarter from the January-March period. Inflation in the second quarter exceeded the central bank’s 2%-4% target and climbed to 6.4% in July, the fastest since October 2018.

Article content

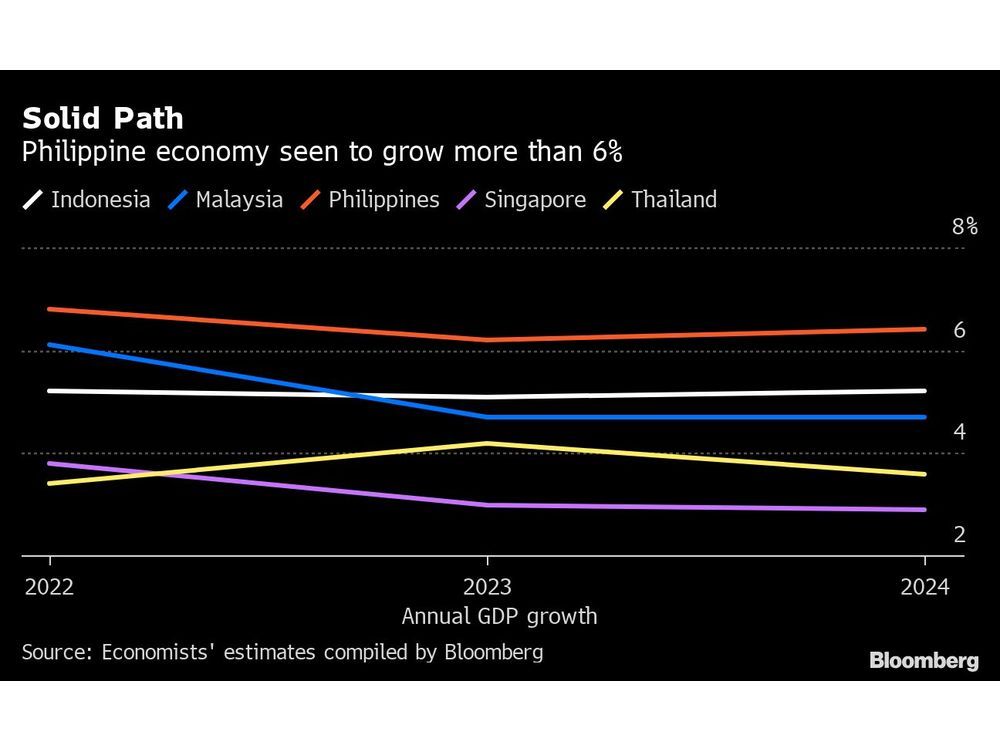

While the second-quarter performance is in line with officials’ forecast for at least 6.5% growth this year, Balisacan said, the expansion in the second half may be slower than the first semester.

The latest GDP print may convince the central bank to slow its policy rate tightening aimed at cooling inflation. Central bank Governor Felipe Medalla had flagged either a quarter- or half-point key rate hike on Aug. 18, and possibly more for the remainder of the year.

The Philippine peso fell 0.1% in early trading Tuesday, while the benchmark stock index was down as much as 0.4%.

“Inflation remains the key consideration over growth,” said Jonathan Koh, economist at Standard Chartered Plc. While the latest number “may lead to some paring back of a 50 basis points hike expectation,” Koh said he still sees a half-point increase this month.

(Updates with more details throughout.)

[ad_2]

Image and article originally from financialpost.com. Read the original article here.