Over time, bitcoin became one of the decade’s most favorable investments and was all the hype in the late 2010s.

Although the asset’s price fluctuates regularly and can be worth some value today and another tomorrow, bitcoin is one of the top choices of cryptocurrency investors, traders, and enthusiasts.

What Is Bitcoin?

Most people know that bitcoin is a cryptocurrency. But for the ones unfamiliar with the term, cryptocurrencies are virtual (or digital) tokens designed to act as money in the real world.

Although cryptocurrencies are intangible (invisible) forms of money, they can do most of the things government-issued money (fiat) can do. The only difference is that a single individual doesn’t control this kind of money. This means that they cannot be manipulated or used by anyone.

Bitcoin is the first of these cryptocurrencies, explaining why it is usually referred to as the “flagship” or the “benchmark” cryptocurrency.

Originally created and introduced to the public in 2009 during one of the most chaotic economic conditions in US history, bitcoin is the creation of a person (or a group of people) under the pseudonym “Satoshi Nakamoto.”

So far, Nakamoto’s creation has become the most popular cryptocurrency in the world. And while some people buy and sell bitcoin for financial returns or fun, others believe this cryptocurrency is the future.

Bitcoin News Updates

Bitcoin is currently in a bear market, and its price has dropped massively from what it once was.

In November 2021, the flagship cryptocurrency was worth almost $69,000. After dropping more than 60%, bitcoin is now worth around $18,700 and shows no signs of slowing down in its descent. However, a few interesting things continue to happen along the way during bitcoin’s drop.

One such interesting thing is the rate of bitcoin’s adoption. The cryptocurrency is now accepted as a valid means of exchange in several countries, including El Salvador in September 2021 and the Central African Republic this year in April 2022.

Another interesting development is how a new study from the University of New Mexico in Albuquerque has suggested that the mining of bitcoin possibly has the same impact in terms of Carbon emissions as cattle farming or burning gasoline when calculated relative to market value.

This new study is significant because, throughout bitcoin’s history, it has faced significant criticism regarding its environmental impact.

Concerns about carbon emissions in 2021 caused the current dip in Bitcoin. This issue became more pressing, especially as bitcoin gained popularity and more miners started to board.

The future of bitcoin depends largely on how soon its miners find alternative energy sources that are less carbon-intensive. And a failure to come up with an alternative means of powering the bitcoin mining rigs may pose serious risks for the price trajectory of bitcoin over the long term.

Bitcoin Historic Price Sentiment

The current dips bitcoin has experienced aren’t the first or worst.

Over the years, bitcoin has experienced several more devastating dips, including one in June 2011 where Bitcoin dropped -99% from $32 to under a penny.

Despite the dips, bitcoin has bounced back severally, even soaring 330% from $18,000 in December 2020 to $64,000 in April 2021.

Massive rises in price typically start during halvings: An event that happens every four years, when the mining rewards from bitcoin get cut in half.

Soon after these bitcoin bull runs, bitcoin enters a dip like the one it is currently trying to get out of. So far, the next bitcoin is halving; therefore, the bull run is expected to happen sometime around 2023-2024.

Bitcoin (BTC) Price Analysis

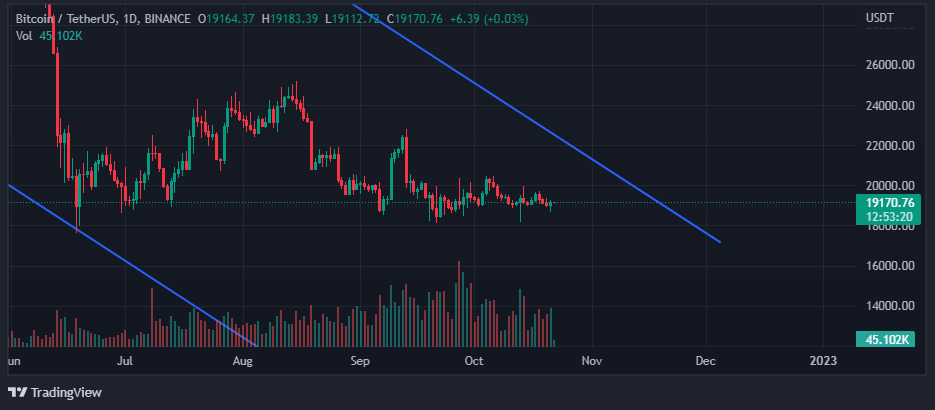

Bitcoin has been in a descending channel since it hit the $69,900 high in November 2021.

Chart showing bitcoin’s price action over the long term | Source: Tradingview

Over the long term, BTC appears bearish and unlikely to change this trend anytime soon. However, zooming in on the chart, we can see that the price of bitcoin is now approaching the upper trendline of the descending channel and may retest this level.

Chart showing BTC approaching the upper trendline of the descending channel| Source: Tradingview

If BTC tests this support level and experiences a breakout, we may see a strong bullish trend on BTC that pushes the prices upwards. However, if bitcoin bounces off this support level, we may see a price rejection and a strong downtrend.

BTC currently appears to have formed a symmetric triangle on its hourly timeframe and is bound to continue its range until a breakout from this formation occurs.

Chart showing BTC in a symmetric triangle on the hourly timeframe | Source: Tradingview

Over the last two weeks, BTC rose 2.7% in mid-October, hitting the $20,000 mark but failing to close above this crucial support.

Like the rest of the cryptocurrencies on the market, BTC has fluctuated ever since and is expected to consolidate further until it hits the upper resistance of the descending channel on its long-term chart around $19,200.

BTC Price Prediction for 2022

Over the long term, BTC seems bearish. This has been the case throughout the year. BTC is largely bearish, and may continue this way.

There are several crypto analysts with varying views on BTC. However, most agree that BTC may soon hit the $100,000 mark.

While many have speculated that BTC may rise and finish the year around the $30,000 or $43,000 zone, other more conservative analysts have predicted that the cryptocurrency may range slightly further and end the year at $25,000 at best.

Chart showing possible BTC trajectory over the next few days | Source: Tradingview

Overall, what BTC does when it hits the crucial overhead resistance over the next few weeks will determine where it heads next.

BTC Price Prediction 2023

According to most analysts, BTC is expected to enjoy better price conditions in 2023 as the next halving nears and may rise and even stay at the $70,000 mark before the third quarter of 2023.

Disclaimer: Voice of crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Crypto Writer

Jim Haastrup is a freelance blockchain and metaverse writer. He helps founders, investors, startups, crypto, and blockchain enthusiasts connect with their audience and win investment through the written word.

Image and article originally from voiceofcrypto.online. Read the original article here.