Article content

(Bloomberg) —

[ad_1]

UK inflation rose more than expected last month to the highest in 40 years, intensifying a squeeze on consumers and adding to pressure for action from the government and Bank of England.

(Bloomberg) —

UK inflation rose more than expected last month to the highest in 40 years, intensifying a squeeze on consumers and adding to pressure for action from the government and Bank of England.

The Consumer Prices Index rose 10.1% in July from a year earlier after a 9.4% gain the month before, the Office for National Statistics said Wednesday. Economists had expected a reading of 9.8%.

The figures add to a cost-of-living crisis, with wages falling further behind rising prices for goods and services of all kinds. Bank of England Andrew Bailey has signaled he’s prepared to raise interest rates further, and contenders seeking to replace Boris Johnson as prime minister are promising further aid to those struggling to pay their bills.

Economists are growing increasingly pessimistic about the UK, with the risk of a recession now seen as far more likely than not due to rising cost pressures. The BOE expects a recession to start in the fourth quarter, lasting into the early part of 2024.

The central bank expects inflation to surpass 13% later this year when regulators allow energy bills to rise again. That would mark the worst reading since September 1980, when Margaret Thatcher’s government struggled to bring a wage-price spiral under control.

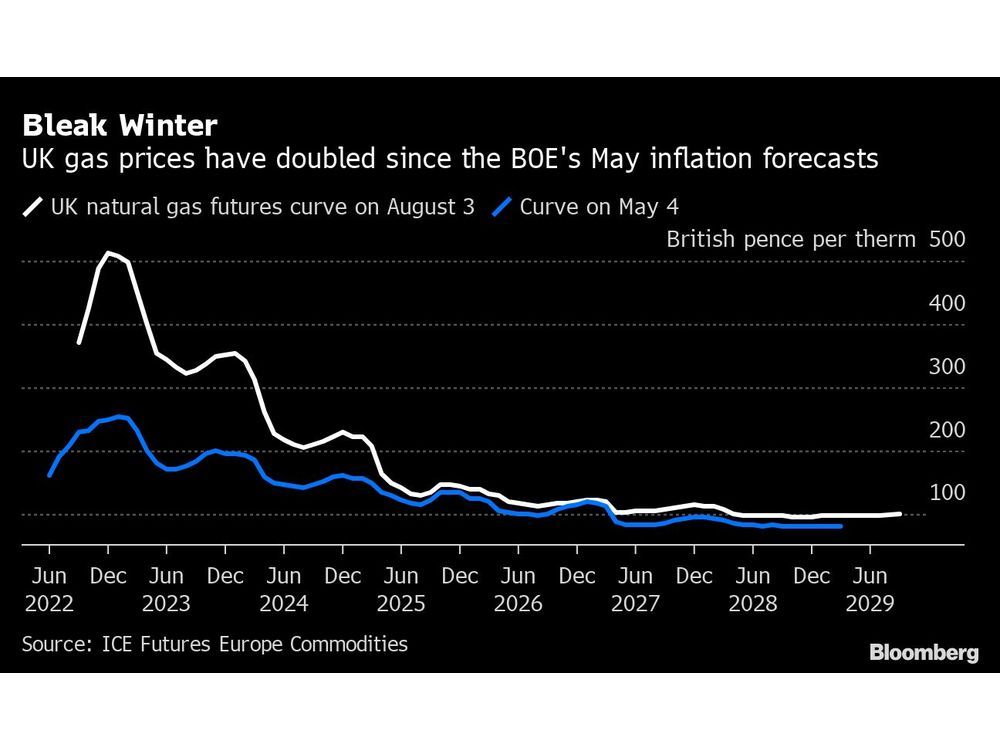

Bailey has blamed Russia for choking off supplies of natural gas, raising the cost of electricity across Europe, for the jump in inflation. Gas futures embedded in the BOE’s forecasts this month were almost double their level in May, and they’ve risen further in the past week.

Those increases are feeding through into the cost of goods and services, prompting people across the country to demand higher wages. Railway workers plan another round of strikes this week, and teachers, barristers and nurses are considering action of their own.

Real wages adjusted for inflation fell 3% in three months though June, the sharpest pace since records began in 2001, a official data published Tuesday showed. Employment increased by 160,000 in the second quarter, 46% less than the three months through May, and job vacancies fell for the first time since August 2020.

Read more:

[ad_2]

Image and article originally from financialpost.com. Read the original article here.