[ad_1]

What happened

Shares of Universal Health Services (NYSE: UHS) climbed 30% this week, according to data from S&P Global Intelligence. The hospital and health-facility services provider saw its shares close last week at $90. On Monday, the stock opened at $90.98. The stock rose to its weekly high at $117.37 on Friday, then closed the week slightly lower, at $117.02. Universal has a 52-week low of $82.50 and a 52-week high of $158.28. The company’s shares are still down more than 9% this year.

So what

Universal has roughly 89,000 employees and, through its subsidiaries, operates 334 behavioral health facilities, 26 acute care hospitals, 39 outpatient facilities and ambulatory care access points, an insurance offering, a physician network, and various related services in the U.S. and the United Kingdom.

A third-quarter earnings report that beat some analysts’ predictions boosted the stock’s price. Analysts had predicted earnings per share (EPS) of $2.43 and revenue of $3.28 billion. Instead, the company reported, on Tuesday, after the market’s close, that it had revenue of $3.33 billion, up 5.7% year over year, and EPS of $2.50, compared to $2.60 in the same period last year. The biggest area of growth was behavioral healthcare services, which saw revenue rise by 8.4%. It is the fourth consecutive quarter the company had increased revenue, though the company said revenue growth wasn’t enough to offset the rate of wage increases and other inflationary costs.

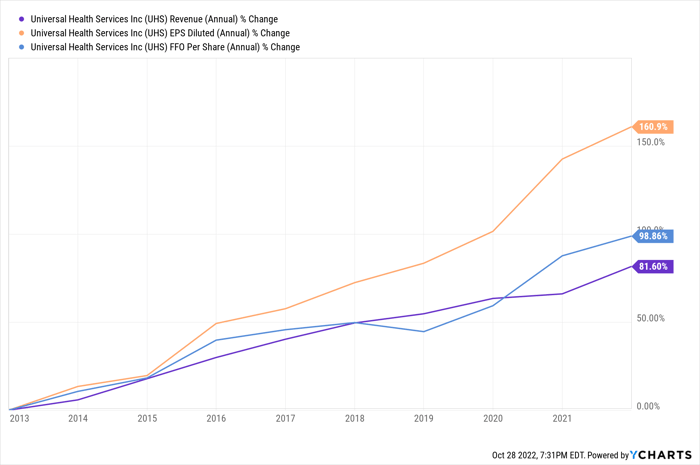

UHS Revenue (Annual) data by YCharts

Now what

The healthcare company is a solid choice for anyone concerned about a recession. Over the past decade, it has increased annual EPS by 160% and revenue by 81%. In some ways, the company is seeing declining profit margins with fewer COVID-19 patients, as they generally had longer stays than typical patients, something the company mentioned in its third-quarter earnings call. However, its business remains steady and the company has increased funds from operations per share by 98% over the past 10 years. Investors will want to see how sticky the inflationary pressures are on its margins in the next quarter.

10 stocks we like better than Universal Health Services

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Universal Health Services wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of September 30, 2022

Jim Halley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.