[ad_1]

Excessive Portfolio Volatility can be Detrimental to Investing Success

Portfolio volatility refers to the degree of fluctuation in an investor’s portfolio. Volatility and risk are somewhat interchangeable terms. An inconvenient truth on Wall Street is that to make money in the stock market, you must take some risk. As the old saying goes, “there are no free lunches” – no risk, no reward. Investors must accept some degree of volatility. At the same time, too much portfolio volatility can be detrimental to success because it can lead to the following:

Higher Emotions:A volatile portfolio can ratchet up emotions for even the most seasoned investors, causing impulsive and irrational decisions in the heat of battle.

Increases the Risk of Ruin: Large portfolio swings and poor risk management can lead to portfolio blow-ups.

Poor Decision Making: Imagine that you’re a professional boxer and were knocked out in your previous fight. In your next bout, you may be hesitant and not perform at your best. The same holds true for investors who took on significant losses in the past. You may be too risk averse when the time comes to take on risk.

Investing is a Marathon, Not a Sprint

Think back to the classic story “The Tortoise and the Hare”. Ultimately, the tortoise won the race because of his steadiness and longevity. While the story is fiction, the same holds true on Wall Street. As Ed Seykota warns, “There are old traders, and there are bold traders, but there are very few old, bold traders.” Below, I will lay out 5 steps you can take to reduce volatility. Though every step may not be suitable for you, I believe you will find value in reading each.

1. Pay Attention to your “Portfolio Mix”: If your portfolio is too volatile, you should first look at the beta of your stocks. Beta measures how much the stock moves versus the S&P 500 Index. For example, Tesla TSLA, a very volatile stock, has a beta over 2 – meaning it moves two times that of the S&P. Meanwhile, Caterpillar CAT, a slower mover, has a beta of 0.79, meaning it moves less than the S&P. As an investor, you can add more stocks like Caterpillar to your holdings or reduce the position size of high beta names to counterbalance your portfolio. You can find the beta on the Zacks quote page:

Image Source: Zacks Investment Research

2. Implement Risk Management Protocols: Did you know?

A 20% loss requires a 25% gain to return to even.

A 50% loss requires a 100% gain to return to even.

A 90% loss requires a 900% gain to return to even.

Avoid big losses! Never dig yourself into a big hole. Job #1 is risk management and living to trade another day.

Reducing position size and avoiding margin can also help to reduce excessive portfolio volatility.

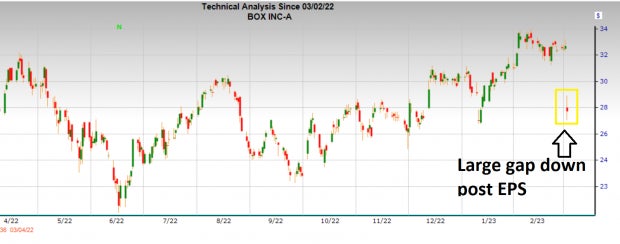

3. Consider ETFs: ETFs can help you eliminate the risk of owning a single stock. Thursday, software company Box Inc BOX gapped down by more than 15% after a poor earnings report.

Image Source: Zacks Investment Research

Conversely, the iShares Software ETF IGV, which holds a diverse set of software stocks like Salesforce CRM, which beat on earnings, was up on Thursday. While you may miss out on some upside by trading ETFs, you can still gain specific industry exposure and avoid earning landmines like Box.

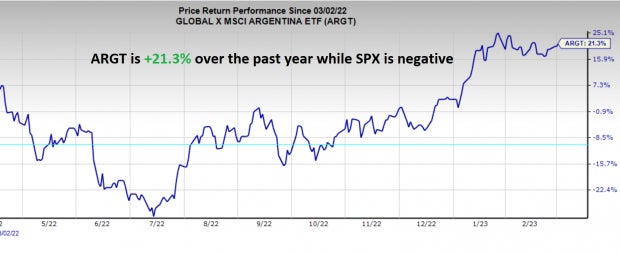

4. Diversify: Diversification does not only refer to spreading capital out between different sectors. With the advent of low-cost ETFs, everyday investors can get exposure to commodities and international markets with the click of a button. For example, the SPDR Energy ETF XLE allows investors to hone in on energy. Most investors would be surprised to find that international markets such as Argentina ARGT and Mexico EWW are drastically outperforming domestic markets.

Image Source: Zacks Investment Research

5. Hedge: Hedging involves shorting positions or buying puts against your longs. Though you will handicap your gains to some degree if your portfolio does what you think it will, hedging can act as insurance. Just like home insurance, you buy it hoping you don’t have to use it but knowing that it will come in handy if disaster strikes.

Bottom Line

There is much more to investing than trying to pick stocks that go up. Investors can do themselves a service by not only studying the market and individual equities, but by also paying attention to their portfolio volatility and its impact on emotions, decision making, and risk.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Salesforce Inc. (CRM) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Energy Select Sector SPDR ETF (XLE): ETF Research Reports

Box, Inc. (BOX) : Free Stock Analysis Report

Global X MSCI Argentina ETF (ARGT): ETF Research Reports

iShares MSCI Mexico ETF (EWW): ETF Research Reports

iShares Expanded Tech-Software Sector ETF (IGV): ETF Research Reports

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.