[ad_1]

AbbVie ABBV will report third-quarter 2022 results on Oct 28, before market open. In the last reported quarter, the company delivered an earnings surprise of 1.81%.

AbbVie’s stock has increased 8.6% so far this year against the industry’s 1.5% decline.

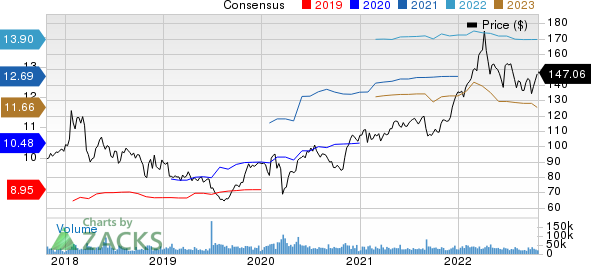

Image Source: Zacks Investment Research

This large drugmaker’s performance has been pretty impressive, with its earnings beating estimates in each of the trailing four quarters. The company has a four-quarter earnings surprise of 1.46%, on average.

AbbVie Inc. Price and Consensus

AbbVie Inc. price-consensus-chart | AbbVie Inc. Quote

Factors to Consider

Strong demand for immunology and aesthetic products is expected to drive AbbVie’s third-quarter 2022 sales. Sales from these two portfolios generate more than half of the company’s total revenues. In addition, the company’s new drug launches in the past few quarters are likely to have generated additional sales in the third quarter. However, currency headwinds are likely to have hurt sales.

AbbVie’s immunology portfolio has been witnessing a strong surge in demand. We expect the company’s flagship drug Humira to register strong growth in the United States, which is more than likely to offset the downward trend in the drug’s international sales due to generic erosion. The Zacks Consensus Estimate for Humira is pegged at $5.55 billion, including $615 million from international markets and the rest from the U.S. market alone.

The company’s new immunology drugs, Skyrizi and Rinvoq, registered strong growth in the past few quarters. The drugs contributed more than $3 billion in combined sales in first-half 2022. The rise in sales is likely due to label expansions of both drugs to include new patient populations in the last few quarters. These label expansions are also expected to drive sales during the third quarter. During the third quarter, Rinvoq received label expansions in European Union in ulcerative colitis and non-radiographic axial spondyloarthritis indications. The Zacks Consensus Estimate for Rinvoq and Skyrizi sales in the third quarter is pegged at $726 million and $1.24 billion, respectively.

AbbVie markets Imbruvica in partnership with Johnson & Johnson JNJ and Venclexta in partnership with Roche RHHBY. We expect JNJ-partnered Imbruvica sales to decline due to novel oral therapies hurting the drug’s sales, while Roche-partnered Venclexta sales are likely to rise as new patient starts are expected to improve. The Zacks Consensus Estimate for J&J-partnered drug, Imbruvica and Roche-partnered drug, Venclexta, is pegged at $1.16 billion and $613 million, respectively. Our model estimates suggest Imbruvica sales to be $1.17 billion, while Venclexta sales are expected to stand at $636 million.

In the aesthetics franchise, we expect Botox sales to rise while Juvederm sales are expected to fall due to the loss of sales in Russia and the impact of COVID in China. ABBV’s suspension of its aesthetics business operations in Russia has affected the company’s sales as Russia is a key market for fillers. In addition, sales of the neuroscience franchise also showed strong growth in recent quarters with additional sales generated by the recently approved migraine drugs Ubrelvy and Qulipta. The trend is expected to have continued for the franchise in the soon-to-be-reported quarter.

The Zacks Consensus Estimate for aesthetics and neuroscience products stands at $1.42 and $1.82 billion, respectively. Our model predicts the aesthetics and neuroscience product revenues to be pegged at $1.46 billion and $1.79 billion, respectively.

On theearnings call investors’ focus will likely be on AbbVie’s strategies around Humira following its potential loss of exclusivity in the United States, which is expected next year. They are also likely to ask questions about the rising competition for other drugs, including Imbruvica, on theearnings call Investors’ focus is expected to be on any update related to the guidance for 2022 due to strong currency headwinds.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for AbbVie this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is -0.05% as both the Most Accurate Estimate is lower than the Zacks Consensus Estimate which stands at $3.56 per share.

Zacks Rank: AbbVie currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here is a large drug stock that has the right combination of elements to beat on earnings this time around:

Eli Lilly LLY has an Earnings ESP of +0.58% and a Zacks Rank #3. You can the complete list of today’s Zacks #1 Rank stocks here.

Lilly’s stock has risen 23.4% this year so far. Lilly missed earnings estimates in three of the last four quarters. Lilly has a four-quarter earnings negative surprise of 5.11%, on average. LLY is scheduled to release its third-quarter 2022 results on Nov 1.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.