[ad_1]

Dividend ETFs seem to have grown in popularity, with net inflows totaling $17.0 billion over the past 3 months and $44.5 billion over the past 12 months, as of 4/29/22. In April, while equity ETFs overall endured $5.9 billion of net outflows, dividend ETFs reported net inflows totaling $7.8 billion1. The increase in demand for dividend ETFs can partly be attributed to the strong relative performance many of these ETFs have provided this year. We expect demand to remain robust for those investors seeking exposure to higher quality stocks, alternative sources of income, and potential dividend growth. To achieve these ends, dividend ETFs employ a variety of strategies. Below, we provide a brief overview of four of our dividend ETFs, highlighting some of the key differences between each approach.

Dividend Sustainability – Winning by Not Losing

First Trust Value Line® Dividend Index Fund (FVD)

We believe strategies focused on dividend sustainability should favor high-quality companies operating in relatively stable or mature industries. Through various stages of an economic cycle, these companies may be able to avoid the dreaded dividend cut and potential downside risk that often follows.

The First Trust Value Line® Dividend Index Fund (FVD) is an ETF that seeks dividend paying stocks with strong balance sheets, relatively stable prices, and above average dividend yields. This process begins by utilizing Value Line’s® research to identify US-listed stocks ranked 1 or 2 (out of 5) for “Safety”. Safety rankings are determined by a stock’s price volatility over the prior five years, as well as an assessment of its financial strength. The latter is measured by several quantitative factors, such as debt-to-capital ratios, amount of cash on hand, level and consistency of sales and profits, and returns on capital. The industry in which a company operates and its position and performance within that industry are also considered. This rigorous evaluation of company fundamentals is intended to help avoid stocks whose dividends initially appear attractive but face a higher risk of being cut. Lastly, from this screened universe, the strategy selects stocks that have a market capitalization of at least $1 billion and an indicated dividend yield higher than that of the S&P 500 Index. The portfolio is equally weighted to eliminate single stock risk and the selection process is repeated monthly.

High Dividend Yield – An Additional Source of Income

First Trust Morningstar Dividend Leaders Index Fund (FDL)

Strategies focused on high dividend-yielding stocks have been around for many years and have often appealed to investors seeking to augment their investment income. By definition, a high dividend yield implies a stock’s price is relatively low compared to its dividend. In some instances, this reflects a perception that dividend cuts could be forthcoming. Consequently, we believe dividend sustainability is key for high dividend yield ETFs.

The First Trust Morningstar Dividend Leaders Index Fund (FDL) is an ETF that selects 100 of the highest dividend-yielding stocks from the Morningstar® US Market IndexSM, excluding any securities issuing dividend payments that do not constitute qualifying income (e.g., real estate investment trusts). Stocks that have cut dividend payments over the past five years are excluded from the strategy, as are those whose forecasted earnings per share do not exceed its indicated dividend per share. We believe this provides fundamental support for the prospect of future dividend payments. The portfolio is weighted based on the total dollar value of indicated dividend payments made by its constituents. The weighting of each holding is capped to enhance portfolio diversification. The index is rebalanced quarterly and reconstituted annually.

Dividend Growth – Keeping Up with Inflation

First Trust Rising Dividend Achievers ETF (RDVY)

Dividend growth strategies are often appealing to investors concerned about high inflation eroding the buying power of their investment income. Thus, the focus for such strategies is not necessarily on the highest dividend-yielding stocks today, but rather on total return and dividend-payers that may be well-positioned to raise dividends in the future.

The First Trust Rising Dividend Achievers ETF (RDVY) selects 50 U.S. stocks that have characteristics supportive of dividend growth. Potential holdings must have a history of raising dividends (over the prior three and five years) supported by earnings growth (over the prior three years). Dividend payout ratios must be below 65% to favor companies that are reinvesting profits in pursuit of future growth. Cash to debt ratios must be above 50%, providing a margin of safety for dividend policies. Finally, 50 stocks with the most attractive combination of dividend growth, dividend yield, and payout ratio are selected, subject to a maximum of 30% from any one sector. The stocks are equally weighted initially and on each rebalancing effective date. The portfolio is reconstituted annually and rebalanced quarterly.

Dividends Plus – Monetizing Volatility with Covered Calls

FT Cboe Vest S&P 500® Dividend Aristocrats Target Income ETF® (KNG)

Investors seeking a higher level of income may also be attracted to dividend ETFs that utilize covered call strategies to bolster distributions. Such strategies generate additional income by selling call options on underlying portfolio holdings. Options premiums are generally higher during periods of increased market volatility.

The FT Cboe Vest S&P 500® Dividend Aristocrats Target Income ETF® (KNG) employs a relatively simple selection process on an annual basis. The portfolio includes stocks from the S&P 500 Index, which have raised dividends for a minimum of 25 consecutive years and meet certain market capitalization and liquidity requirements. As of 4/29/22, there were just 64 stocks that have accomplished this unusual feat. In addition to dividends, this ETF generates income by writing covered calls on a portion of its portfolio, targeting a distribution rate that is approximately 3% higher than the dividend yield of the S&P 500 Index (before fees). While KNG is allowed to write calls on up to 20% of the notional value of each of its individual holdings, its income objective can generally be achieved with a much smaller overwrite percentage. This is important because performance is capped for shares against which a covered call has been written. As of 3/31/22, the option overwrite percentage for KNG was just 5.37%, meaning 94.63% of the portfolio had no constraints on upside participation.

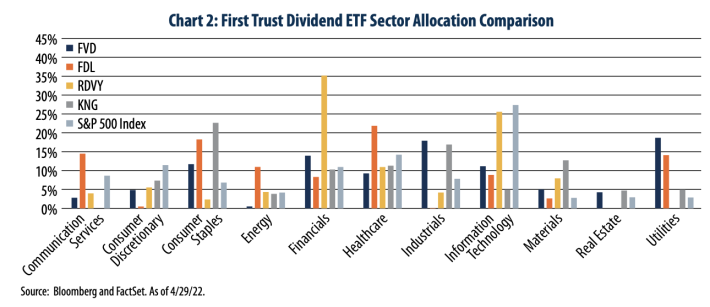

Sector Allocations for Dividend ETFs

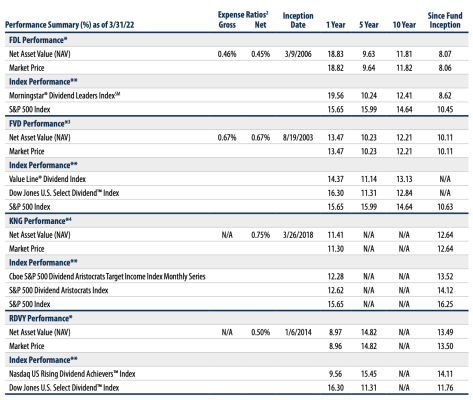

Based on their underlying strategies, dividend ETFs provide varying sector exposures (see Chart 2). For example, FVD’s focus on high quality and low volatility has led to an overweight in dividend payers from the industrials (17.9%) and utilities (18.7%) sectors. By focusing on high dividend yield, FDL’s largest sector exposures are to the health care (21.9%) and consumer staples (18.3%) sectors. RDVY, which invests in stocks believed to have strong prospects for future dividend growth, has its largest allocations to the financials (35.2%) and information technology (25.6%) sectors. Finally, by targeting stocks with a long history of raising dividends, KNG allocates to mature companies from a variety of sectors, with its largest allocations to the consumer staples (22.7%), industrials (16.9%), materials (12.7%) and health care (11.3%) sectors.

This year has brought a renewed focus on dividend ETFs, and we believe this trend is likely to continue. With numerous ETFs from which to choose, there are no “one size fits all” solutions. Rather, different dividend ETFs may help investors achieve a variety of objectives, such as gaining exposure to higher quality stocks, alternative sources of income, or potential dividend growth. As always, we believe that investment professionals play a key role in determining which ETFs best meet investors’ needs.

Performance data quoted represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares when sold or redeemed, may be worth more or less than their original cost. You can obtain performance information which is current through the most recent month-end by visiting www.ftportfolios.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.