[ad_1]

Walmart‘s (NYSE: WMT) inventory woes from earlier this year are winding down. That’s the takeaway from the company’s recentearnings call anyway. The shares rallied more than 6% after CEO Doug McMillion commented that “we’ve made good progress to improve our inventory position,” and then went on to illustrate how. And to be fair, the world’s largest brick-and-mortar retailer does seem to have an improving handle on its aging, decreasingly marketable merchandise than it did just a couple of quarters ago.

But if you think the company’s inventory situation is no longer a glaring liability, think again. The matter could still up-end Walmart stock.

Walmart is still well-stocked — perhaps too well

Walmart (like many other retailers) aggressively restocked store shelves late last year and early this year, anticipating a post-pandemic consumerism recovery that never quite lived up to expectations. It’s a problem simply because much of its merchandise is seasonal. The longer it sits on a shelf, the more difficult it becomes to sell… even at a discount. Moreover, not only do these goods take up valuable room, they also represent money that could otherwise be used to purchase new, more marketable merchandise. That’s a big reason Walmart’s profit margin rates have been shrinking of late.

But the company reports making progress on this front last quarter. In addition to the aforementioned comment from McMillon, the company’s official third-quarter report notes: “We significantly improved our inventory position in Q3, and we’ll continue to make progress as we end the year.”

The market is taking McMillon at his word. But don’t be too quick to embrace the optimism. While Walmart’s likely taking all the measures it says it’s taking and successfully addressing its inventory bloat, it’s still got plenty of problems to tackle.

The image below tells the tale. Last quarter’s top line grew 8.8% year over year. Inventory levels, meanwhile, grew by 12.2%. Indeed, the $64.7 billion worth of goods the company is currently sitting on is not only a new record, but its current inventory-to-sales ratio of 42.7% is the second-highest reading in several years. The highest is the first quarter’s 43.6%, when the retailer first started turning up the heat on clearing out its excess inventory.

Data source: Walmart Inc. Chart by author. Dollar figures are in billions.

There are three major footnotes to add here. First, know that almost all retailers bolster inventory levels during Q3 in preparation for the holiday shopping season, so while the sheer scope of the increase is significant, it’s not entirely out of line.

Second, much of Walmart’s sky-high inventory levels from earlier this year is the result of goods being trapped within the retailer’s supply chain and not in stores where it could be sold. And third, inflation is raising Walmart’s wholesale costs, thereby inflating the raw value of its inventory.

Nevertheless, the company’s inventory levels are still unusually high relative to sales, and they’re unusually high at a point in time when consumers may not be as buying-minded as some are suggesting. Walmart rival Target just dialed back its holiday sales outlook, while Amazon issued disappointing fourth-quarter revenue guidance late last month.

More than a little near-term risk

Don’t misread the message. Walmart isn’t doomed. It will correct its inventory missteps sooner or later. It’s making progress toward that end right now, in fact, if the retailer’s understanding of its challenges is any indication.

As an example, Walmart’s merchants know they must carefully navigate future purchases of goods with long lead times, particularly if they’re imported. It also knows it’s got $1 billion worth of seasonal springtime goods that are almost unmarketable now, particularly with spring 2023 goods soon on the way. It’s a problem, to be sure, but knowing the near-exact depth of the problem is a solid start to solving it.

The fact is, Walmart still probably has got far more inventory in its stores than it would care to have on hand at this point in time. This poses a significant threat to its profitability, since markdowns and deep discounts of this merchandise chip away at gross margins.

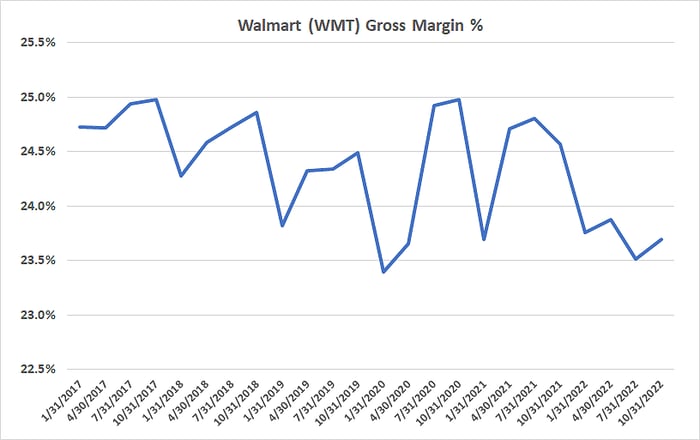

The image below puts this matter in perspective. While its Q3 gross margin rate of 23.7% is up slightly from the second quarter’s, the bigger trend is pointed down moving into Q4. And notice how Q4 gross margins are usually the lowest of the year as the retailer focuses more on volume and less on protecting its margins.

Data source: Walmart Inc. Chart by author.

Given this tendency on top of profitability that’s already clearly slipping against a backdrop of shaky consumer strength, Walmart’s Q4 bottom line could prove particularly disappointing. Unless you’re really getting in for the long haul, now may not be the time to step into the stock at all.

10 stocks we like better than Walmart Inc.

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart Inc. wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 7, 2022

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Target, and Walmart Inc. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.