[ad_1]

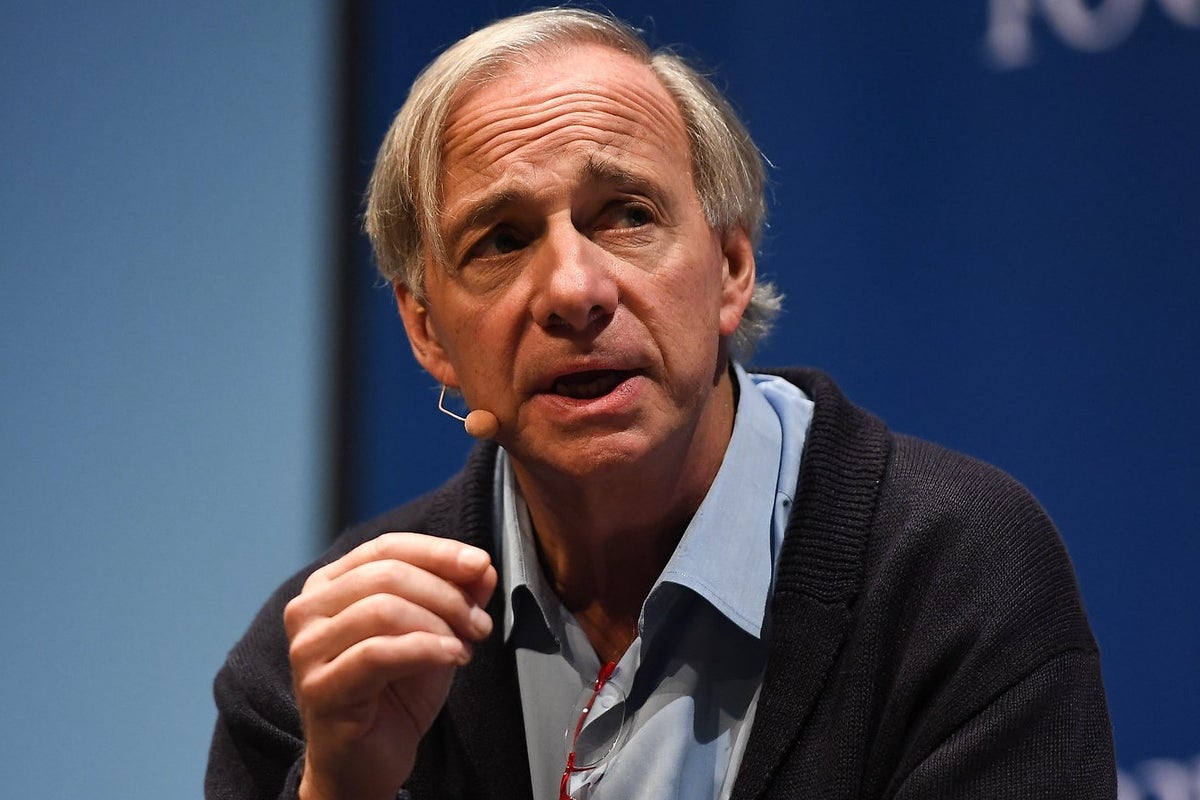

Bridgewater Associates is an American hedge fund founded by billionaire investor Ray Dalio, it’s the world’s largest hedge fund, with approximately $23.6 billion assets under management, as of August 2022.

If you are looking to invest like Bridgewater Associates, here are three dividend stocks that offer future growth potential as well as passive income.

Go To: Have Tech Stocks Bottomed? World’s Largest Hedge Fund’s Holdings Suggest Yes

AT&T Inc T is offering a dividend yield of 6.12% or $1.11 per share annually making quarterly payments, with an inconsistent track record of raising its dividends. AT&T is the third-largest U.S. wireless carrier, connecting 68 million postpaid and 17 million prepaid phone customers.

AT&T delivered subscriber growth near second-quarter record levels with 316,000 AT&T Fiber net adds, bringing total net additions over the past two years to nearly 2.3 million, including ten consecutive quarters of more than 200,000 net adds.

Pfizer Inc PFE is offering a dividend yield of 3.27% or $1.60 per share annually utilizing quarterly payments, with a strong track record of increasing its dividends over the past 11 years. Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 vaccine sales).

As of March 2022, Pfizer purchased $2 billion or 39.1 million shares at an average cost of $51.10 per share, with no plans to repurchase more shares in the second half of the year.

Schlumberger Limited SLB is offering a dividend yield of 1.90% or 70 cents per share annually through quarterly payments, with no track record of increasing its dividends in the past year. Schlumberger is the largest oilfield service firm in the world, with expertise in a myriad of disciplines, including reservoir performance, well construction, production enhancement, and more recently, digital solutions.

In the second quarter of 2022, Schlumberger saw sequential revenues rise by 14%, with year-over-year revenue growth of 20%, and raised its full-year revenue outlook to at least $27 billion.

Photo: Courtesy of Web Summit on flickr

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.