[ad_1]

Investors are always on the lookout for innovative companies that can continue to adapt to current times, trends, and technological advances.

Next week’s earnings lineup will feature two such companies that investors may want to consider buying.

Agilent Technologies (A)

Many companies out of the Zacks Computer and Technology sector are innovative in nature, and Agilent Technologies stands out in this regard with the company set to report its fiscal first-quarter earnings on Tuesday, February 28.

Agilent is considered an original equipment manufacturer (OEM) with a long history in communications, electronics, semiconductor, test and measurement, life sciences, and chemical analysis industries.

Following its spinoff from Hewlett Packard (HPE), Agilent launched its IPO in 1999 and in recent years has continued to diversify its research and testing solutions into new end markets.

Agilent stock currently sports a Zacks Rank #2 (Buy) with earnings estimates revisions trending slightly higher throughout the quarter which has been rare for many tech stocks amid higher inflation.

Image Source: Zacks Investment Research

Q1 Preview & Outlook

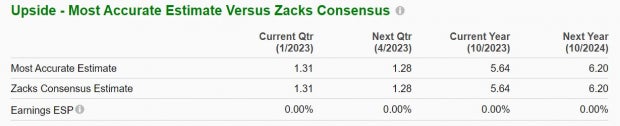

Agilent’s Q1 earnings are projected at $1.31 per share, up 8% year over year. The Zacks Expected Surprise Prediction (ESP) indicates Agilent should reach earnings expectations with the Most Accurate Estimate also having Q1 EPS at $1.31. On the top line, first-quarter sales are expected to be $1.69 billion, up 1% YoY.

Image Source: Zacks Investment Research

Agilent’s annual earnings are now forecasted to rise 8% in FY23 and jump another 10% in FY24 to $6.20 per share. On the top line, Sales are expected to be up 1% in FY23 and rise another 7% in FY24 to $7.46 billion.

Performance & Valuation

Agilent has a strong history, and its top and bottom line growth remains impressive which is very intriguing with its Electronics – Testing Equipment Industry also in the top 43% of over 250 Zacks Industries.

Furthermore, Agilent stock is up +6% over the last year to largely outperform the S&P 500’s -10% and the Nasdaq -17%. Even better, since spinning off from Hewlett Packard in 1999, Agilent shares are up +234% and near the performance of the broader indexes to largley outperform HPE stock.

Image Source: Zacks Investment Research

Agilent stock also trades attractively from a historical valuation standpoint at $142 a share and 25.3X forward earnings which is near the industry average and nicely below its decade-long high of 41.6X and close to the median of 24.5X.

Sterling Infrastructure (STRL)

Out of the Industrial Products sector, Sterling Infrastructure is an innovative engineering company whose stock is intriguing before its fourth-quarter report on Monday, February 27. Sterling stock is edging toward higher highs with its Engineering – R and D Services Industry currently in the top 22% of all Zacks Industries.

The operator of E-Infrastructure, Building, and Transportation Solutions also sports a Zacks Rank #2 (Buy) going into its quarterly release with earnings estimates trending higher for the company’s fiscal 2023 as it wraps up FY22.

The rising earnings estimates could continue as Sterling announced on Thursday that it was awarded a monumental site development project for the Hyundai Engineering America EV battery facility in the state of Georgia.

Image Source: Zacks Investment Research

Q4 Preview & Outlook

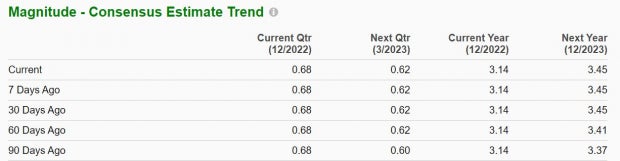

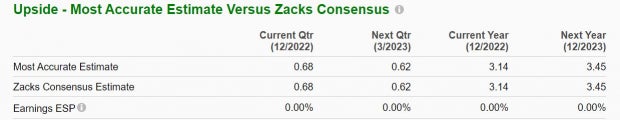

The Zacks Consensus for Sterling’s Q4 earnings is $0.68 per share, up 84% from EPS of $0.37 in the prior year quarter. The Zacks Surprise Prediction indicates Sterling should reach its quarterly earnings expectations with the Most Accurate Estimate also at $0.68 a share. Sales for the quarter are expected to be up 9% YoY at $439.10 million.

Image Source: Zacks Investment Research

Overall, Sterling earnings are now forecasted to climb 46% to $3.14 a share for FY22 compared to EPS of $2.15 in 2021. Plus, Fiscal 2023 earnings are expected to jump another 10% to $3.45 per share. Sales are now projected to pop 21% for FY22 and be virtually flat in FY23 at $1.93 billion.

Performance & Valuation

The top and bottom line growth of Sterling is very attractive, especially when considering STRL’s strong performance since it went public in 2001, now up an impeccable +4,704% to crush the performances of the broader indexes.

Image Source: Zacks Investment Research

More intriguing for investors is that Sterling stock is up +29% over the last year continuing its dominating performance which has also outperformed the broader indexes. Sterling stock currently has an “A” Style Scores grade for both Growth & Value. Trading at $37 per share and just 10.7X forward earnings, shares of STRL trade well below its decade-long high of 298.8X and nicely beneath the median of 12.6X.

Bottom Line

Investors will certainly want to keep Agilent Technologies (A) and Sterling Infrastructure (STRL) on their radars as there could still be plenty of upside and opportunity in these innovative companies. This will be especially true if they are able to provide strong quarterly reports and positive guidance.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.