[ad_1]

The prospects of a less hawkish fed could certainly propel many Consumer Discretionary stocks as higher interest rates have a very ill effect on the business industries within the sector.

With a more positive sentiment growing toward these equities as business operations become stronger, here are three Zacks Rank #1 (Strong Buy) Consumer Discretionary stocks investors may want to consider buying for 2023 and beyond.

Century Casinos (CNTY)

First up is Century Casinos, whose stock sticks out in terms of growth and valuation and carries an affordable price tag of $9 a share at the moment.

Century Casinos’ business operations revolve around developing and operating gaming establishments and the company along with its subsidiaries currently owns and operates a limited-stakes gaming casino in Cripple Creek, Colorado as well as pursuing several additional gaming opportunities internationally and in the U.S.

Image Source: Zacks Investment Research

What is certainly intriguing along with Century Casinos’ attractive stock price is the rising earnings estimate revisions for fiscal 2023. CNTY’s fiscal 2022 earnings are now expected to dip -38% to $0.41 per share compared to EPS of $0.66 a share in 2021 but FY23 earnings are projected to rebound and climb 145% to $1.01 per share.

Image Source: Zacks Investment Research

Even better, Century Casinos’ stock trades at just 9.7X forward earnings and well off its decade-long high of 111.6X and 48% beneath the median of 18.9X with the industry average at 19.6X. Shares of CNTY are up 38% in 2023 to outpace the rally among the broader indexes and there could certainly be more upside looking at the company’s valuaton.

Las Vegas Sands (LVS)

Another Consumer Discretionary stock investors may want to consider buying in 2023 is Las Vegas Sands. As a leading international developer of multi-use integrated resorts primarily operating in the U.S. and Asia, Las Vegas Sands stock is also enjoying favorable earnings estimate revisors to the upside.

Las Vegas Sands fiscal 2023 earnings are expected to rebound and climb to $1.41 per share compared to EPS of -$1.20 in 2022. More impressive, FY24 earnings are forecasted to soar another 93% to $2.73 per share.

Image Source: Zacks Investment Research

Furthermore, while other Consumer Discretionary stocks have plummeted over the last year, LVS stock is now up +23% to outperform the broader sectors -21% and the S&P 500’s -10%. Year to date, LVS is up +19% to also outperform the Consumer Discretionary sectors’ +15% collective performance and the benchmark’s +9%.

Plus, shares of LVS trade at $57 per share and 41.2X forward earnings but this is well below its absurd decade-long high of 3,735X and closer to the median of 20.4X. While the industry average is at 19.6X forward earnings, LVS’s rising earnings level the playing field.

Image Source: Zacks Investment Research

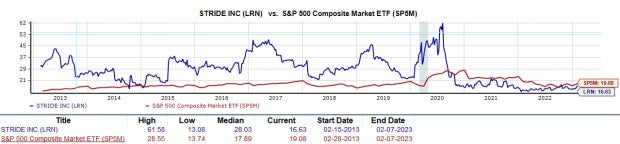

Stride (LRN)

Rounding out the list is Stride Inc., a premier provider of K-12 education for students, schools, and districts, including career learning services through middle and high school curriculums.

Earnings estimate revisions have started to trend higher for Strides fiscal 2023 and FY24 over the last 30 days. FY23 earnings are now projected to be virtually flat but jump 14% in FY24 at $2.87 per share.

Image Source: Zacks Investment Research

This could certainly provide more steam to Stride stock, which is now up +15% over the last year to largely outperform the majority of its Consumer Discretionary peers and the benchmark. This is largely attributed to Stride’s strong performance to start 2023, up +30% YTD.

More importantly, trading at $40 a share, Stride’s stock trades at 16.6X forward earnings which is beneath the industry average of 17.3X. This is also 72% below its decade high of 61.5X and a 40% discount to the median of 28X.

Image Source: Zacks Investment Research

Bottom Line

With these Consumer Discretionary stocks trading attractively relative to their past, the rising earnings estimate revisions are a great sign that there could still be more upside left after their recent rallies. Cooling inflation should create a better operating environment and produce a stronger consumer which could continue to boost the strong performances of Century Casinos, Las Vegas Sands, and Stride stock.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Century Casinos, Inc. (CNTY) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.