[ad_1]

If you’re a new investor, 2022 was a rude awakening.

A bull market that spanned more than 12 years came crashing to an end, and the S&P 500 and the Nasdaq both finished 2022 with their worst year since 2008.

However, that shouldn’t dissuade you from starting to invest now. In fact, 2023 could be a great year to start investing. Here’s why.

Image source: Getty Images.

1. Stocks are down

When most things are cheap, consumers want to buy more of them, but with stocks, falling prices tend to scare away buyers.

However, the same principle applies to stocks as it does with anything else. When something’s cheap you can buy more of it for the same price, which makes 2023 a great time to start investing. Using the ratio of stock prices to corporate earnings as a measure of valuation, the S&P 500 now trades its cheapest level in years.

If you’re a net buyer of stocks, you should remember that falling stock prices are a good thing, as they allow you to buy more shares of the stocks you’re interested in.

It’s also worth remembering that while the broad market is down 20%, a number of stocks have fallen significantly further. Those include the popular FAANG stocks, such as Alphabet and Amazon, which have respectively lost 40% and 50%, and industry-leading growth stocks such as Shopify and Roku, which dropped more than 70% in 2022.

While there’s no guarantee that those stocks will recover in 2023, they are all trading at historically low valuations, giving investors good odds for a comeback.

2. Interest rates are up

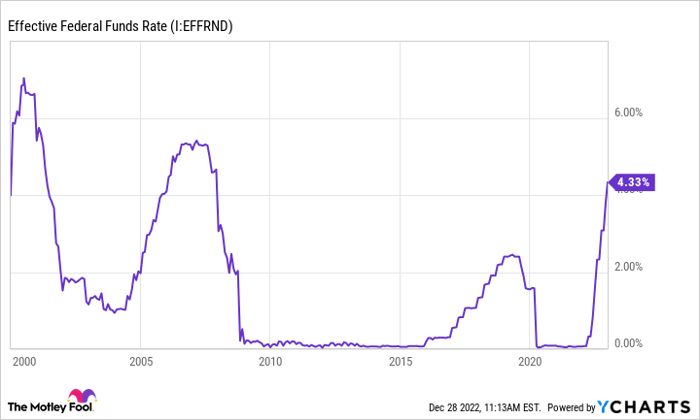

Stock prices and interest rates have an inverse relationship. That means they tend to move in opposite directions, and the spike in interest rates in 2022 was a major reason stocks fell last year. Essentially, investors are willing to pay more for stocks in a lower-rate environment because the yields on bonds — the main alternative to stocks — are lower, and in a higher-rate environment, investors tend to move money out of stocks into bonds.

However, going into 2023, the federal funds rate is now elevated, in a range of between 4.25% to 4.5%, the highest it’s been since 2007.

Effective Federal Funds Rate data by YCharts

In its most recent statement earlier in December, the Federal Reserve forecast a slight increase in the benchmark federal funds rate, calling for an additional increase of 75 basis points to bring inflation back down to its target of 2%. However, over the long run, the central bank expects interest rates to fall again after 2023, slowing to a “longer run” range of 2.3% to 2.5% as inflation normalizes.

That means stocks should benefit over the coming years as interest rates begin to recede.

3. You can’t time the market

If you have cold feet about investing in 2023, it’s probably because you’re afraid stocks will fall even further. That could be true, as most economists are predicting a recession in 2023, but it’s difficult to predict the market bottom since the stock market, as a leading indicator, tends to rebound before the economy does. You might get lucky, but it’s basically impossible to time the market on a consistent basis, and trying to do it is generally a waste of time.

The best investors, like Warren Buffett, focus on buying high-quality stocks at a fair price, which has proved to be a better approach than market timing.

If you wait too long to buy stocks, you could also miss the recovery, which could be a much greater mistake than buying stocks too early before the market hits bottom.

As the popular saying goes, time in the market beats timing the market, and if you’re a new investor, the best way to take advantage of the wealth-creating power of the stock market is to start now and let the magic of compounding work for you.

10 stocks we like better than Walmart

When our award-winning analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Stock Advisor returns as of December 1, 2022

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon.com, Roku, and Shopify. The Motley Fool has positions in and recommends Alphabet, Amazon.com, Roku, and Shopify. The Motley Fool recommends the following options: long January 2023 $1,140 calls on Shopify and short January 2023 $1,160 calls on Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.