[ad_1]

It’s the most critical time for stocks – earnings season.

Investors have been receiving a surplus of quarterly results daily for some time now, with companies finally providing much-needed updates.

And, of course, this could easily be the most consequential week of the season, with many mega-cap tech titans slated to report.

One such titan, Alphabet GOOGL, is on deck to reveal its quarterly results on February 2nd, after the market close.

It raises a valid question: how does the company stack up? Let’s take a closer look.

Cloud Computing

Cloud computing has gained rapid traction among businesses, allowing many to achieve digital feats that otherwise felt impossible. Of course, Alphabet has that covered with its Google Cloud, a key line of business that’s been a solid growth driver for the company and will be monitored closely.

For the quarter, our consensus estimate for Google Cloud revenue stands firm at $7.3 billion, suggesting an improvement of more than 32% year-over-year.

In addition, it’s worth noting that Alphabet has exceeded our consensus Google Cloud revenue estimate in four of its last six quarters, posting a 2.8% beat in its latest release. The chart below illustrates this.

Image Source: Zacks Investment Research

Another player in the cloud computing industry, Microsoft MSFT, has already reported its quarterly results. Microsoft’s Intelligent Cloud raked in $21.5 billion, exceeding our consensus estimate marginally and growing 18% year-over-year.

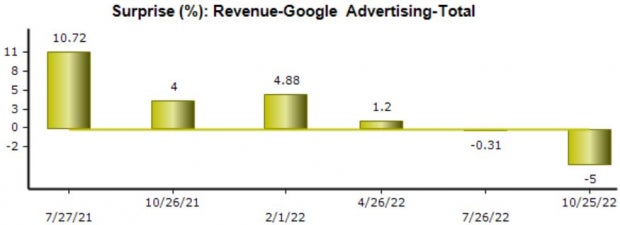

Advertising

It’s no secret that the digital advertising market has been weak, as this is typically one of the first expenses companies cut when faced with a challenging macroeconomic backdrop.

This was further confirmed in Alphabet’s latest release; GOOGL fell short of our consensus advertising revenue estimate by more than 7%.

For the upcoming quarterly release, the Zacks Consensus Estimate resides at $59.9 billion, indicating a pullback of roughly 2% year-over-year. Further, GOOGL has fallen short of advertising revenue expectations in back-to-back releases.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish in their earnings outlook, with three negative earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $1.17 suggests a pullback of roughly 23.5% year-over-year.

Image Source: Zacks Investment Research

Still, the top line is in better shape; the Zacks Consensus Sales Estimate of $63.2 billion indicates a 2% climb from year-ago quarterly sales of $61.9 billion.

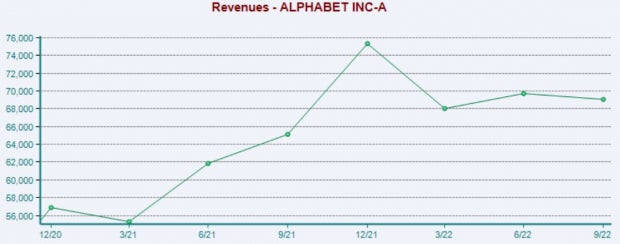

Quarterly Performance

Alphabet has struggled to exceed quarterly estimates as of late, falling short of earnings and revenue estimates in three consecutive quarters.

In the company’s latest release, GOOGL fell short of earnings expectations by nearly 15% and reported sales 2% below expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Valuation

Following rough price action in 2022, Alphabet’s valuation multiples have returned to earth; currently, GOOGL shares trade at a 19.2X forward earnings multiple, well beneath the 26.2X five-year median.

Image Source: Zacks Investment Research

Further, the company’s forward price-to-sales works out to be 5.1X, again beneath the 6.9X five-year median by a notable margin.

Image Source: Zacks Investment Research

Putting Everything Together

A crucially important week of earnings season is led by big tech, with Alphabet on deck to reveal its quarterly results on February 2nd, after the market close.

Investors will closely monitor the company’s cloud revenue, as it’s been a solid top line contributor as of recently. Microsoft MSFT, another player in the cloud computing space, posted results that exceeded our expectations marginally.

In addition, Alphabet’s advertising revenue will also be closely monitored, as it’s well known that the digital advertising market has cooled off.

Analysts have taken a bearish stance for the quarter to be reported, with estimates indicating a pullback in earnings and a slight uptick in revenue, a reflection of margin compression.

Further, valuation multiples have pulled back extensively, with the company’s forward price-to-sales and forward earnings multiple residing below their respective five-year medians.

Heading into the release, Alphabet GOOGL is a Zacks Rank #3 (Hold) with an Earnings ESP Score of -0.7%.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don’t miss your chance to download Zacks’ top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

>>Send me my free report on the top 5 EV stocks

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.