Article content

(Bloomberg) — Europeans returning from their summer breaks will find a more fragile economy that risks buckling under the threats of energy rationing, record inflation and tighter monetary policy.

[ad_1]

Europeans returning from their summer breaks will find a more fragile economy that risks buckling under the threats of energy rationing, record inflation and tighter monetary policy.

![lr)d3qcg6wc]froy73gbqgwn_media_dl_1.png](https://stockstowatch.net/wp-content/uploads/2022/08/Europe-Slips-Toward-Recession-as-ECB-Mulls-Steps-Ahead-Eco.jpg)

(Bloomberg) — Europeans returning from their summer breaks will find a more fragile economy that risks buckling under the threats of energy rationing, record inflation and tighter monetary policy.

Purchasing managers’ indexes due Tuesday will likely show private-sector output shrinking for a second month, adding to signs that a recession in the 19-nation euro zone is now more likely than not. Business confidence gauges from Germany, France and Italy will probably confirm that direction.

Germany, Europe’s largest economy, has emerged as the region’s weak spot, with its outsized industrial base suffering disproportionately from surging energy costs and a persistent shortage of supplies. Meanwhile, services aren’t seeing the same kind of tourism boom that’s tiding over countries around the Mediterranean as vacation travel picks up post-Covid.

An update on Germany’s second-quarter performance on Thursday will reveal whether the negligible contraction initially reported, small enough to be rounded away, will be revised into a bigger one, or whether consumer spending was strong enough to avert a decline in output — for now.

Data in the coming week will be key ingredients for discussions on where monetary policy is headed after the European Central Bank raised rates by half a point in July and signaled “further normalization” in September without pre-committing on the size. The ECB’s next meeting is less than three weeks away, and most policy makers have yet to express their preferences.

An account of the July meeting due on Thursday may offer some insight, and about half of the ECB’s 25 rate setters — including Executive Board member Isabel Schnabel and Bundesbank chief Joachim Nagel — will get a chance to share their views during the Kansas City Fed’s annual Economic Policy Symposium in Jackson Hole, Wyoming.

ECB President Christine Lagarde won’t make the trip to the Grand Tetons this year. But her comments following the July decision, along with another pickup in inflation to just under 9% and expectations that price pressures will increase further, suggest she’s leaning toward a bigger move: “We have to bring inflation down to 2% in the medium-term,” she said. “It’s time to deliver.”

What Bloomberg Economics Says:

“Minutes from the ECB’s July 21 meeting may offer clues on whether investors should brace for another 50-basis-point rate hike in September. Given widespread inflationary pressures, a large increase is our base case.”

—Maeva Cousin, senior economist. For full preview, click here

Central bankers from around the world are also headed to Jackson Hole, with Federal Reserve Chair Jerome Powell scheduled to speak on Friday. Before that, Chinese banks will likely trim their benchmark loan prime rates for the first time in months, while monetary policy authorities in Israel, Iceland, South Korea and Botswana are among those expected to hike rates.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Europe, Middle East, Africa

Elsewhere in western Europe, it’s a fairly quiet week, with UK PMI readings scheduled for Tuesday.

In the east, data due on Wednesday will likely show that Russian industrial production slumped in July at the fastest rate since the start of President Vladimir Putin’s war in Ukraine, as energy output falls amid a standoff with the rest of the continent.

Iceland’s central bank is expected to raise its key rate by 75 basis points to 5.5%, keeping it ahead of developed-nation peers in tightening as a housing boom there keeps fueling price growth.

The Bank of Israel is set to increase its benchmark by another half point after annual inflation and economic growth topped all forecasts, with price gains accelerating to the quickest since October 2008.

Botswana may also hike again to curb average inflation that’s at the highest level in more than a decade. The International Monetary Fund said in July that the central bank will need to continue raising rates to bring price growth back within the 3% to 6% target range.

South African data will probably show that inflation in July remained above the 6% top of the central bank’s target range for a third straight month, fueled by gasoline prices. The institution, which is scheduled to meet next on Sept. 22, told lawmakers in a recent presentation that a return to the target band was “likely to be sluggish,” with risks tilted to the upside.

US

Powell at Jackson Hole on Friday morning is the week’s main event. His remarks on the economic outlook are expected to reaffirm the US central bank’s resolve to keep raising rates to curb decades-high inflation, though he’s not likely to specify to how big officials will go when they meet in September.

Policy makers raised rates by 75 basis points in July for the second straight meeting and have said that a similar hike could be on the table again — or potentially a smaller, half-point move — depending on the data.

Economic data in the coming week include the government’s July personal income and spending report, which will help shape third-quarter growth estimates. Inflation-adjusted outlays on goods and services are projected to have firmed a bit in July after soft readings the previous two months.

The report’s personal consumption expenditures price index, which the Fed uses for its inflation target, is forecast to settle back after energy costs plunged. Other data include revised second-quarter gross domestic product, durable goods orders and new home sales for July, and the August S&P Global manufacturing and services surveys.

Asia

China’s biggest banks on Monday are likely to lower the interest rate they charge their best customers, after the People’s Bank of China cut borrowing costs on Aug. 15.

Indonesia’s central bank may retain its outlier status in a world where central banks have been delivering large hikes, though more economists see the potential for an increase at Tuesday’s meeting after the nation’s inflation accelerated in July.

The Bank of Korea meets Thursday amid growing fears that further half-percentage hikes may pop a household debt bubble. Those concerns could prompt Governor Rhee Chang-yong to revert to a 25 basis point move before he jets off to Jackson Hole. The BOK decision follows the latest preliminary export figures earlier in the week that will offer a pulse check of global trade so far in August.

In Japan, board member Toyoaki Nakamura will deliver the BOJ’s latest view on the economy and prices in a speech on Thursday ahead of Tokyo inflation numbers Friday.

Pakistan’s central bank, which has hiked rates by 525 basis points this year, is expected to keep them steady when policy makers meet.

Latin America

When Banxico hiked its key rate to a record 8.5% on Aug. 11, policy makers failed in the post-decision statement to provide forward guidance. Mexico watchers will pore over the meeting minutes posted midweek.

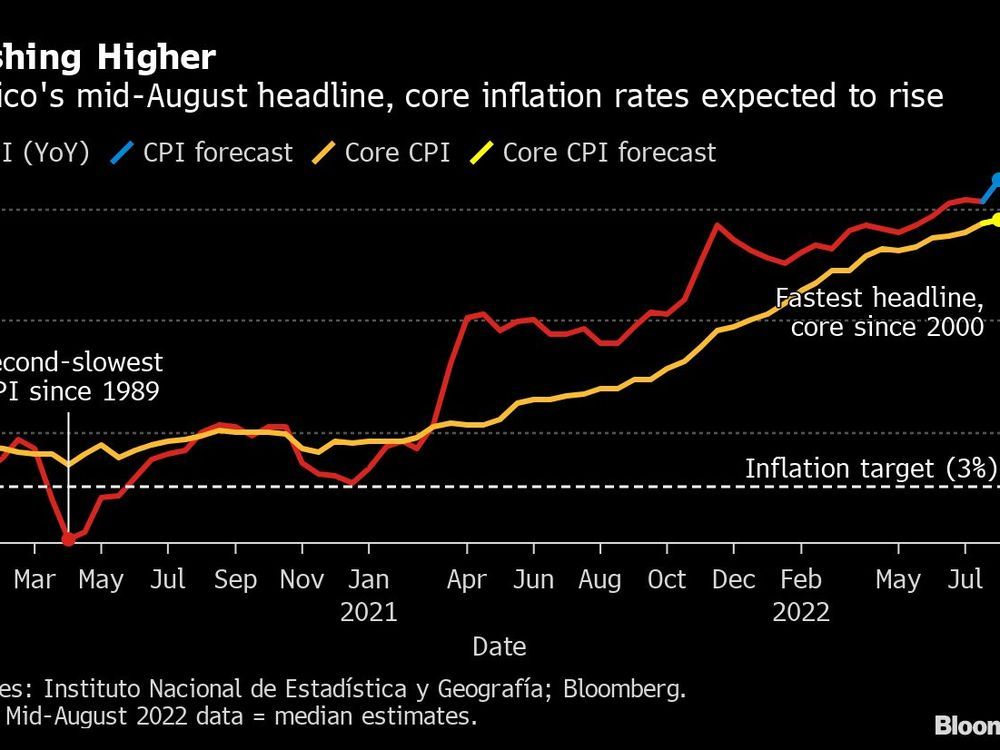

Mexico also reports final second-quarter GDP data, June’s economic activity index, and the mid-month reading of consumer prices, which economists see hitting a fresh 21-year high. Banco de Mexico Deputy Governor Gerardo Esquivel on Wednesday said inflation will peak in August or September.

In Peru, look for a modest increase in second-quarter output as a new round of pension savings withdrawals in June backstopped consumers.

The surprising pick-up in Argentina’s May GDP-proxy data likely helped to buoy June’s results, but headwinds abound and many economists forecast a recession in the second half.

In Paraguay, the central bank meets to consider a 13th straight hike from 8%, with inflation running slightly faster than 11%.

Brazil posts current account and foreign direct investment results as well as the mid-month reading of it benchmark inflation index. Early estimates see the IPCA-15 index coming in at just over 10%, down from 11.39% in July. It’s being slowed largely by government price and tax cuts.

[ad_2]

Image and article originally from financialpost.com. Read the original article here.