[ad_1]

Denbury jumps after Bloomberg says Exxon considering takeover

Exxon Mobil (XOM) is considering a takeover of Denbury (DEN), Kiel Porter of Bloomberg reports, citing people familiar with the matter. Exxon has expressed preliminary interest in Denbury but no final decision has been made, sources told Bloomberg. In August, Bloomberg reported that Denbury is working with an adviser to explore a sale.

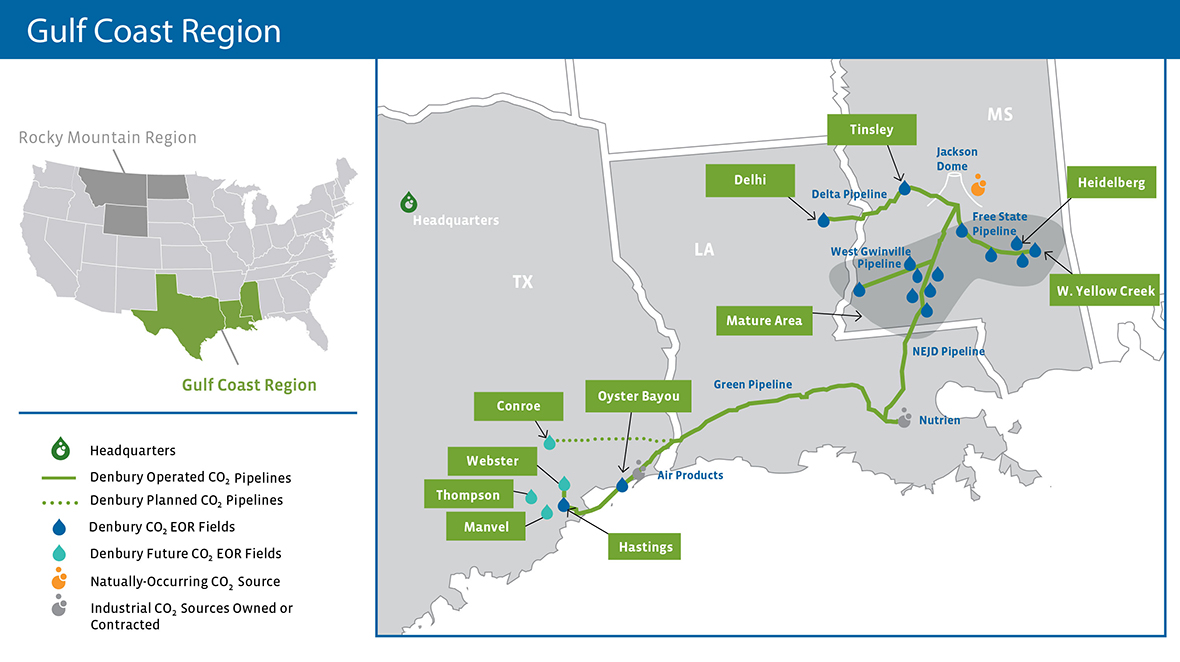

Denbury Inc., an independent energy company, focuses on producing oil from mature oil fields in the Gulf Coast and Rocky Mountain regions. The company holds interests in various oil and natural gas properties located in Mississippi, Texas, and Louisiana in the Gulf Coast region; and in Montana, North Dakota, and Wyoming in the Rocky Mountain region. As of February 24, 2022, it had 192 million barrels of oil equivalent of estimated proved oil and natural gas reserves.

Denbury is working with investment bankers at JPMorgan on negotiations to be acquired by a strategic buyer, according to Street Insider, citing a source who reportedly added that the talks may not lead to a definitive transaction. Previously, on August 17, Bloomberg’s Kiel Porter, Gillian Tan, and Kevin Crowley reported that Denbury was exploring options, including a possible sale.

Key Bank

After Bloomberg reported that Denbury (DEN) hired bankers to explore a sale and mentioned ExxonMobil (XOM) as a potential buyer, shares are outperforming sharply today, noted KeyBanc analyst Tim Rezvan. M&A for Denbury has been an “active debate topic with clients” since his launch of coverage, when shares were in the $75-$85 per share range, and with the shares “flirting with the $100/share level today,” he believes “there is clearly M&A upside in the share price,” said Rezvan. The analyst, who noted that the company did not provide a comment when he reached out for information, has an Overweight rating on Denbury shares.

DEN shares are up 6% to $98.05.

[ad_2]

Image and article originally from www.stockwinners.com. Read the original article here.