[ad_1]

The stock market can be a tough place to make money. With millions of investors trying their luck, it is critical that the informed investor is putting in the time to study, evaluate and assess the fundamental factors affecting stock prices through various stock valuation methods. The valuation process is one of the most critical frameworks for determining the current cost per unit. However, there are multiple yardsticks to consider for valuing a stock such as current market price, purchase price, and future dividends. Here’s a list of some of the most popular.

Stock Valuation Methods:

When talking about methods of stock valuation, there are two main categories: Absolute Valuation and Relative Valuation. The Absolute Valuation model attempts to find the intrinsic or “true” value of an investment based on fundamentals. It focuses on metrics like dividends, cash flow, and the growth rate for a single company without focusing on other companies.

The other method, the Relative Valuation model, compares one company to others in its peer set. This one involves calculating multiples and ratios, such as the price-to-earnings multiple, and comparing them to the multiples of the companies in the same sector.

1. Asset Reproduction Value

Type: Balance sheet valuation, Absolute

When to use: When you need to determine the cost that a competitor will incur to replicate the business of the company.

Description: This method involves evaluating the company’s current assets and identifying the replacement cost for each asset. The replacement cost can be assessed in multiple ways. The most popular asset-based valuation models are the square footage method, unit-in-place method, quantity survey method, and index method.

To understand the method in detail, click here.

Pros: Very elaborative and helps in finding the company’s assets’ true worth in the market. Especially relevant for M&A cases.

Cons: A company’s valuation cannot be only based on its visible net worth. It is also usually only applicable to manufacturing companies and business owners with a large proportion of fixed assets.

2. Benjamin Graham Valuation Formula

Type: Earnings stock valuation method, relative.

When to use: For cash-cow companies with a stable business model.

Description: Also called Graham’s number, as the name suggests, the formula was given out by Benjamin Graham, the father of “Value Investing.” The Graham number is used for estimating the fundamental value of a stock. The formula:

![]()

The 22.5 comes from Graham’s thought process that any stock that has a PE ratio above 15 and a Price-to-Book ratio of 1.5 is overvalued. The 15*1.5 gives us the magic number of 22.5 for the formula. The calculated value is a ‘reasonable valuation’ as per Graham’s formula.

To understand the method in more detail, click here.

Pros: Useful to identify undervalued stocks.

Cons: Too simplistic.

3. Earnings Power Value (EPV) By Bruce Greenwald

Type: Earnings stock valuation method, absolute.

When to use: For cyclical companies, volatile cash flows, and newly formed companies where less information is available such as financial statements.

Description: This method assumes two conditions

- Zero growth

- Current sustainable profits

That means that the company shall sustain its profit levels each year, but the profit growth will be zero. The method uses a logical approach to calculate the potential intrinsic value approach.

The formula for EPV is — Adjusted earnings/Cost of Capital. To understand the method with an example, click here.

Pros: Does not require estimates for future growth, the actual cost of capital, profit margins, and required investments.

Cons: It only looks at the past financial statements and balance sheets of the company.

Recommended Stock Investing Posts:

4. PE Model For Stock Valuation

Type: PE multiplier stock valuation process, relative

When to use: For valuing any company with stable earnings

Description: The Price to Earnings Ratio or the P/E Ratio is the relationship between a company’s stock price and earnings per share (EPS). The P/E ratio is one of the most popular valuation models. It reflects the market expectations with regards to the price that has to be paid per unit of earnings (current or future).

Earnings are important to value a company’s stock as investors need to evaluate the profitability of the business and its future profitability.

The High PE Ratio companies are considered growth stocks. It is indicative of positive future performance.

Whereas, companies with a Low PE Ratio are considered value stocks. This indicates that they are undervalued because their current price trades lower relative to their fundamentals. However, this is a very general statement, and the PE ratio needs to be taken into context with the company size and industry.

To read more in detail, click here.

Pros: Can be used for any company.

Cons: Can be used only while comparing companies within the same sector.

No time to value your own stocks?

The Motley Fool’s Stock Advisor brings you two winning stock picks every month.

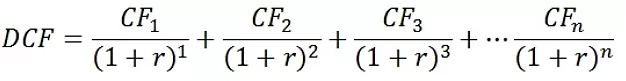

5. Discounted Cash Flow Valuation

Type: Cash flow valuation, absolute

When to use: Consistent free cash flow, bigger companies, predictable companies.

Description: Discounted cash flow valuation method is used to estimate the value of an investment based on its future cash flow models. DCF analysis calculates the present value of expected future cash flows using a discount rate. A present value estimate is then used to evaluate the potential investment.

Where CF = Cash Flow for the year, r = discount rate

To understand in detail, click here.

Pros: Accounts for time value of money

Cons: Assuming future cash flows is a risky business. Just ask Nokia and Blackberry.

6. Reverse Discounted Cash Flow

Type: Cash flow valuation, absolute

When to use: Figure out market expectations embedded in the stock price

Description: The reverse discounted cash flow eliminates the need of predicting future cash flows. The reverse DCF model calculates the growth rate that the market is applying to the current stock price which tells whether the market’s implied growth rate is higher or lower than what the company is capable of achieving. This model uses the stock price as the starting point and helps the investor decide if the expectations from the company are reasonable or not.

To understand in detail with an example, click here.

Pros: Eliminates shortcomings of the DCF model to a great extent

Cons: It only indicates if the stock’s assumed growth rate is consistent with the company’s previous growth rate.

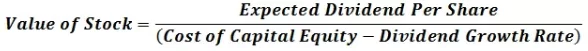

7. Dividend Discount Model

Type: Cash flow method, absolute

When to use: For a direct comparison of companies belonging to different industrial sectors. It is applied usually for cash cows only.

Description: The formula:

![]()

The commonly used DDM method is the Gordon growth model (GGM). It assumes a stable growth in dividends year after year. This model assumes three variables:

D = the estimated value of next year’s dividend

r = the company’s cost of capital equity

g = the constant growth rate for dividends, in perpetuity

To understand better with an example, click here.

Pros: Considers time value of money.

Cons: Fails when the company has a high growth rate.

Key Takeaways From These Different Stock Valuation Methods:

- There are multiple stock valuation methods.

- No one method can be applied universally for valuing stocks.

- Understanding the context and the reasons behind the valuation numbers is equally important.

Related Investing Product Reviews:

[ad_2]

Image and article originally from www.modestmoney.com. Read the original article here.