[ad_1]

Baidu, the leading Chinese web search provider and a key player in cloud AI services and autonomous driving, also uses Nvidia chips extensively in its data centers. Last October the company announced one of the world’s largest AI models for generating language, built using Nvidia hardware.

ByteDance, the Chinese company behind TikTok and its counterpart in China, Douyin, relies on Nvidia hardware to train its recommendation algorithms, according to its own software documentation. Several Chinese companies, including Alibaba and Baidu, are developing silicon chips designed to compete with those from Nvidia and AMD, but these all require manufacturing from outside China that is now off-limits. Alibaba and Baidu both declined to comment on the new rules. WIRED did not receive responses to requests for comment made to ByteDance and several other Chinese chip firms.

Big Tech companies in China—as in the US—have made large AI models increasingly central to applications including web search, product recommendation, translating and parsing language, image and video recognition, and autonomous driving. The same AI advances are expected to transform military technology in the years to come, and shape how the US and China butt heads over issues like Russia’s invasion of Ukraine and Taiwan’s claims to independence.

“The Biden administration believes that the hype around the transformative potential of AI in military applications is real,” says Allen of CSIS. “The United States also has a pretty good understanding of which computer chips are going into Chinese military AI systems, and they are American, which is viewed as unacceptable.”

The new export restrictions contribute to the steady decline in US-China relations in recent years, despite decades of technological codependence during which Chinese manufacturing has become the bedrock of the US tech industry. In recent years, the US government has sought to take a more active role in boosting its domestic AI industry and chip production due to an increased sense of competition with China.

Shares in several Chinese tech firms, as well as Nvidia and AMD, fell this week as the scope of the restrictions sank in with investors. The Department of Commerce had warned Nvidia and AMD last month that they would have to halt exports of advanced AI chips to China, but the rules announced last week are far broader. The new export rules add to a bruising 18 months for China’s tech firms, after a broad government crackdown aimed at regulating the industry more tightly after years of freewheeling growth.

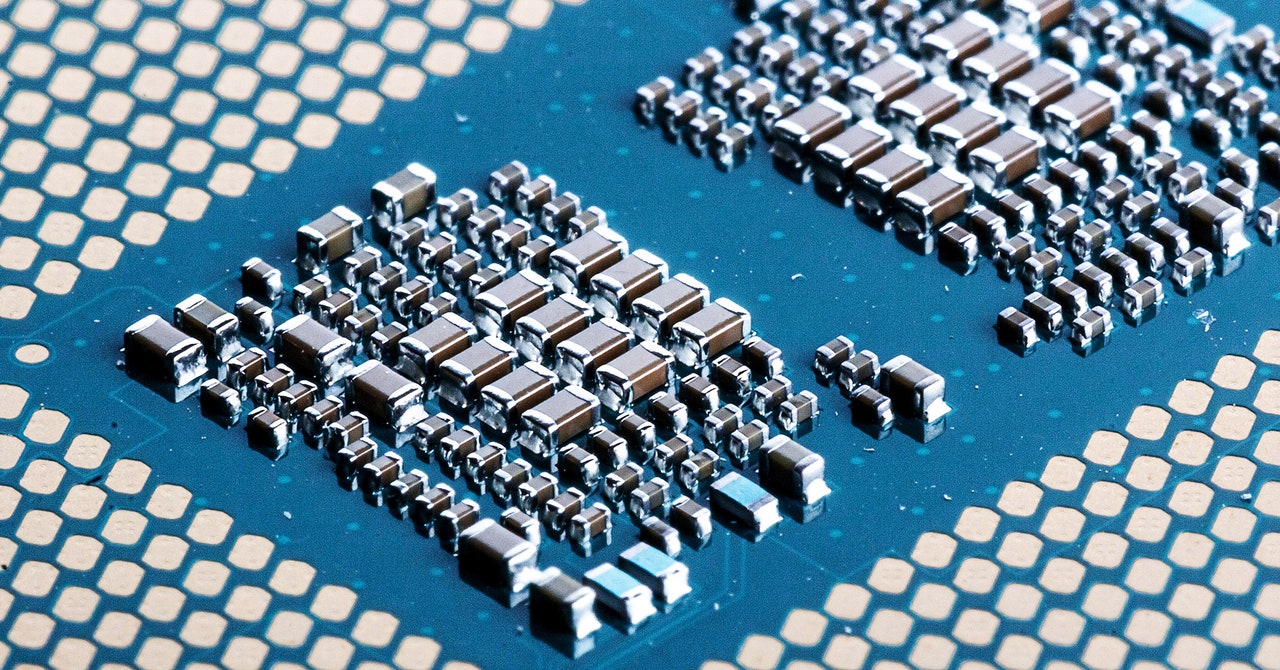

Being cut off from US chips could significantly slow Chinese AI projects. China’s leading domestic chipmaker, Semiconductor Manufacturing International Corporation (SMIC), produces chips that lag several generations behind those of TSMC, Samsung, and Intel.

SMIC is currently manufacturing chips in what the industry calls the 14-nanometer generation of chip making processes, a reference to how densely components can be packed onto a chip. TSMC and Samsung, meanwhile, have moved to more advanced 5-nanometer and 3-nanometer processes. SMIC recently claimed that it can produce 7-nanometer chips, albeit at low volume.

The capacity of any Chinese company to keep pace with advances in chip manufacturing is limited by its lack of access to the extreme ultraviolet lithography machines needed to make chips with components smaller than those of the 7-nanometer generation. The sole manufacturer, ASML in the Netherlands, has blocked exports to China at the request of the US government.

[ad_2]

Image and article originally from www.wired.com. Read the original article here.